Automated Policy Compliance

Gain a powerful ally with a T&E management solution that effortlessly ensures corporate policy compliance—freeing your teams to focus on more strategic work.

Gain a powerful ally with a T&E management solution that effortlessly ensures corporate policy compliance—freeing your teams to focus on more strategic work.

Your organization’s T&E polices are configured into Certify, allowing automated controls to guide employee spend and keeping costs consistently within budget. When booking travel with Certify Travel, automated controls are fused with our user-friendly interface that allows employees to customize results to match their personal preferences.

In Certify, finance can configure your expense and approval rules across multiple departments and job roles in the system.

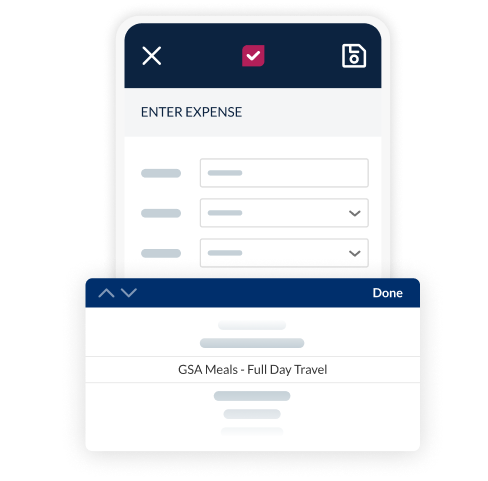

Our powerful policy engine helps companies, government agencies, and contractors easily navigate the complex T&E policies set by the U.S. General Services Administration (GSA).

Simplify the process for employees and administrators with flexible configurations for three GSA reimbursable types. Accurate calculations for reimbursable expenses are then displayed inside Certify, helping users know exactly how much they’ll be reimbursed.

Certify offers a simple solution for tracking all spending—and all required fields—to ensure your organization stays compliant with the U.S. Physician Payments Sunshine Act.

Our software integrates with the NPI database so that you can track expenses for specific Physical and Organization NPI records. Finance teams can create reports with just a few clicks, viewing physician spend by employee, category, expense total, NPI, and more.

Testimonials

The Certify app has made expensing on-the-go life changing. Always being in and out of the office, it is so much easier to snap a photo and submit the expense for reimbursement

This software couldn't be easier to use. Everything is so intuitive. I recently made a mistake that I needed to have changed and I called customer care. I immediately was taken to a real person who was more than willing to help out. She fixed the problem immediately and set me on the correct track.

The Certify customer service team is unbelievable. They are always willing to help, and I can't remember the last time I had to wait longer than five minutes to hear back!